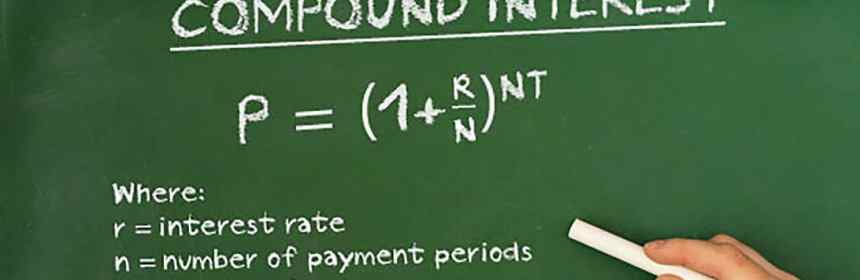

What Is Compound Interest?

This is the most important concept to understand if you plan to stay debt free forever.

And for you to understand exactly how it works, I’ll ask you a question, which you may have heard before: What would you rather have, $1,000,000 in cash right now, or one penny today, two pennies tomorrow, four pennies the next day, eight pennies the next one and so on for the next 30 days?

Most people would choose the million dollars, and it is a good choice, I mean, who wouldn’t want a million dollars? However, the second option is much better. Look at the following table to see the power of compound interest in action:

Day 1: $.01

Day 2: $.02

Day 3: $.04

Day 4: $.08

Day 5: $.16

Day 6: $.32

Day 7: $.64

Day 8: $1.28

Day 9: $2.56

Day 10: $5.12

Day 11: $10.24

Day 12: $20.48

Day 13: $40.96

Day 14: $81.92

Day 15: $163.84

Day 16: $327.68

Day 17: $655.36

Day 18: $1,310.72

Day 19: $2,621.44

Day 20: $5,242.88

Day 21: $10,485.76

Day 24: $83,386.08

Day 25: $167,772.16

Day 26: $335,544.32

Day 27: $671,088.64

Day 28: $1,342,177.28

Day 29: $2,684,354.56

Day 30: $5,368,709.12

As you can see in the table above, a penny doubled every day gives you over $5,000,000 in just 30 days. This is how powerful compound interest is. And this is what credit card companies are using against you.

When you make charges on your credit card, you pay interest on any balance you carry (balance would be any unpaid amount on your credit card statement). This interest is calculated not only on the initial principal but also the accumulated interest of prior periods.

Compound interest can really hurt you, especially if you are making the minimum payment on each of your credit cards. When you carry a balance, compound interest is calculated daily, which means every day interest is added to your balance. If you pay the minimum payment on a credit card, you are only making the bank richer.

To show you compound interest in action, consider that if you have a credit card with $5,000 balance at 18% a year, and you were to pay only the minimum payment (let’s say it’s 3% of your balance), it would take you 199 months to pay it off! (Assuming that the rate doesn’t change and you never use your card again). So your account will be paid off in exactly 199 months (over 16 years!) and you will have paid $4,698.46 in interest ( source – Bankrate credit card calculator). This is insane.

This is what banks don’t want you to know. Send them only the minimum payment and they will love you forever.

I see you don’t monetize onepercentfinance.com, don’t waste your

traffic, you can earn additional cash every month

with new monetization method. This is the best adsense alternative for any type of website (they

approve all websites), for more details simply search in gooogle: murgrabia’s tools