Mortgage Loan Basics

Mortgage loan – A mortgage loan, also referred to as a mortgage, is used by purchasers of real property to raise funds to buy real estate; – wikipedia

If you own your own home you may not even think of your mortgage as debt. You may even believe that the house is really yours. Well, it’s not until you pay off the mortgage loan. You need to understand how mortgage loans work if you want to be truly debt-free (and own your house).

Home mortgages operate the same way that credit cards do. The difference is that mortgage companies will never say that the interest on their loans is compounded daily (maybe in their fine print, buried among hundreds of pages that you sign at closing). But if understand how compound interest works, you may start to realize that it only makes sense to pay off your mortgage as soon as possible.

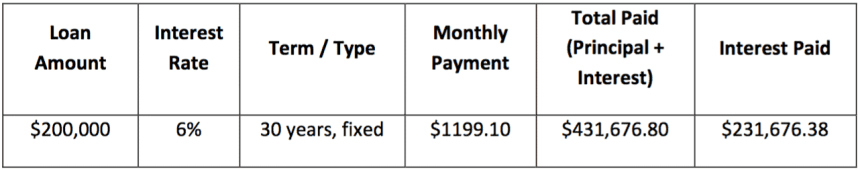

Most people just assume that the interest on their mortgage is simple interest. When they get a 6% (arbitrary number for the sake of this article) interest rate, they think that the interest they pay will be 6% of the total amount they financed, calculated yearly…but nothing could be further from the truth. In reality, if you paid off your whole mortgage in one year, then yes, the interest rate would be 6% (well, actually a little more because of the compounding effect, but I’m trying to illustrate a point here). But if it is paid over 30 years, then the actual interest rate is well over 100%! Think about it! You could buy more than 2 houses with the same money!

The reason that the interest rate is so important is that you’re paying compound interest, not simple interest. The higher the interest rate, then obviously, the more interest you will pay. Remember back in the day, when interest rates were much higher? I have seen people with a 9.8% interest on their $300,000 loan; in 30 years they will have paid over $631,000 in interest alone! That’s over 200% interest!

These examples are extreme, I know…however, they do not compare to the other types of mortgage loans that are causing so many people lose their homes.

One of them is the so called “Interest Only” loans. Basically you only pay the interest portion of the payment, deferring the difference (thereby accumulating interest, which is added to your account). It means that you are not only NOT paying down the balance of your loan, but you are also adding more interest (you are adding interest to the balance you didn’t yet pay). If property values are going up, then it may not be a bad loan in some specific cases (i.e., buying a house with the intention of selling it in a few months); however, in a declining market it is financial suicide. The only way somebody would benefit from an Interest Only mortgage loan is if they were sending some money to be applied towards the principal every month and the interest rate is substantially lower than they had before (if they are refinancing). On purchases it was a good option when houses appreciate very quickly, but obviously very risky.

The riskiest mortgage loans available are called Option ARM (Adjustable Rate Mortgage) or Pick A Pay loans. Every month, you get to pick which payment (out of four) you will send to the mortgage company. This is a good option for professionals or business owners whose income fluctuates sharply from month to month, but definitely NOT for most people.

With option 1 you send less than that month’s interest (which means, the difference is added to the balance, collecting more interest.) For example, let’s take a $200,000 loan with a Fully Amortizing rate (the real rate that would pay off the loan in 30 years) of 7.683% and a minimum payment rate of 1.25%. The option one payment will be $666.50 (deferring $614 of the interest that was due that month, which automatically is added to the balance and starts collecting interest)

With option 2, you send only the interest for that month (which means, you are not paying down the balance! Following the previous example, you would send $1,280.60 for that month, but the balance is not paid down.

With option 3, you send the regular payment (principal and interest) calculated over 30 years. In this example, it will be $1,423.58.

And with option 4 you send the regular payment calculated over 15 years instead of 30, but it will be obviously substantially higher. Following our example that payment would be $1,874.88

Can you guess which payment most people usually send?

I have seen mortgage statements from banks where the option that is highlighted in the payment coupon (or in big, bold letters) is always the minimum payment (option 1). This leads people to believe that’s the payment they should send, and many people send just that. I’ve seen a scenario where a borrower added $60,000 to his mortgage loan in just 2.5 years without realizing what was going on. In my experience, many people were not well informed when they were offered these loans.

Option Arm loans can spell trouble, especially when property values decline and home owners owe more than their house is worth. To add insult to injury, when people refinance they discover that the interest rate is always higher on an Option Arm loan than on a 30-year fixed loan! Fortunately, these types of loans are not so popular in the US right now as they were in the early 2000’s.

As you can see, ignorance is not bliss, it’s expensive.

Many people believe that paying off their mortgage is a bad financial decision, and they have two arguments to back up this position. I respect both arguments, but I don’t have to agree with either one. The first argument is that a home mortgage has tax benefits (since mortgage interest can be deducted from your taxes); the second is that since the interest on a mortgage is usually low (approx. 3.5 to 6% in the last few years depending on many factors like your credit, etc), you will benefit by making regular payments to your mortgage lender and investing your discretionary income elsewhere, as long as the interest on your investment is higher than the interest on your mortgage.

Let’s look at both arguments. As far as the mortgage interest being tax deductible, what it really means is that if you pay, let’s say, $10,000 in mortgage interest in a given year, you will save $2,500 in taxes (if you are at a 25% bracket; it would be even less money if you are at a lower bracket!). Think about this for a moment. Does it really make financial sense to you? Paying the bank $10,000 to get back $2,500? If you are like me, it will not make any sense at all. It makes more sense to pay off the mortgage, and once it’s paid off, you get to KEEP the $10,000 (or whatever you would have paid in interest) as disposable income or as investment money.

As far as investing your money somewhere else that could give you a higher return (higher than your mortgage interest), let me offer the following facts to you: whatever interest you pay on your mortgage, will be the GUARANTEED interest you will make by paying it off (or paying it down). You cannot guarantee the performance of any other investment, as you probably already know. Market conditions fluctuate and could affect your investments; however, paying off your 6% mortgage is a guaranteed 6 % “return”.

And let’s face it, most people, are not keen investors. Many will have a Mutual Fund or retirement account that they rarely review, and investing does take a lot of planning and research. Without proper planning and research you could be “throwing darts” at your financial future. When you consider this, then paying off your mortgage early does make financial sense due to its simplicity and high return. However, if you are a keen investor, then it may make sense not to pay off your mortgage and invest your discretionary income somewhere else.

Thanks for sharing. Informative blog about mortgage loan basics. To avail best offer on the mortgage loans please visit website https://loansparadise.com/mortgage-loans-in-hyderabad.php

Pingback: 7 Strategies That Will Help You to Get Out of Debt